Table of Content

You can claim relief if you live with your parents as long as you can provide rent receipts. 2) The yearly rent amount minus 10% of the taxpayer’s adjusted total income. 2) You have not received HRA at any time during the year for which you are claiming 80GG HRA.

So, as long as you satisfy the conditions for claiming HRA for the rented house and conditions for claiming benefits for the home loan for the house owned by you independently, there is no restrictions on your eligibility to claim both at the same time. Please note that in case you are claiming the HRA benefit but not staying in that accommodation, the Income Tax Department can take penal action against you for providing inaccurate information in your ITR. So, this twin benefit can and should only be claimed in genuine cases and not for tax evasion purpose. Though you may have to forgo the principal repayment related deduction, but you would be able to get a maximum deduction of Rs 2 lakh on interest payment of your home loan. For many people it may work out well as they may not need principal repayment benefit at all because it may be exhausted through other avenues like EPF contribution, NPS contribution, children’s education fee, life insurance and investments like ELSS, PPF, ELSS, NSC and so on. If your annual interest payment is much higher than Rs 2 lakh then there are changes that your net loss from income from house property is above Rs 2 lakh giving you full deduction benefit despite rental income.

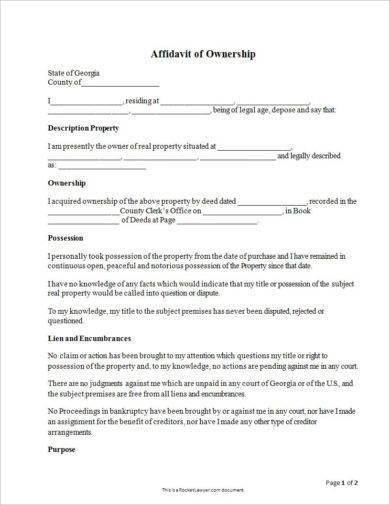

Documents for HRA Exemption Claim

Since receipt of HRA is a precondition, every salaried cannot claim the benefit of HRA. He is eligible to claim HRA exemption for rent paid and deduction of interest on the home loan. Just like in the case above, the two houses in one city where you can not live due to employment in another city can be easily considered as self-occupied. And since you are living on rent in another city, then you can claim HRA if it is part of your salary, and you are paying the rent.

In case of a let-out house, you can only claim tax deduction on the interest payment of a home loan. So, if the reason is related to place of employment, claiming both deductions together will not be difficult. "As per the Income-tax Act, an individual may claim deduction for interest on housing loan for a property which cannot be occupied by the individual due to his employment, business or profession carried on at any other place," says Iyer. "However, such an individual should be careful and maintain substantive evidence to prove that he has to reside at the any other place due to his employment," adds Iyer.

Personal loan in Kadappa – Check Eligibility and Apply Online

It is often seen that some salaried people live in rented accommodations in the city of their work while their families live in a different city in a self-owned property purchased with a home loan taken out by the employee. These employees frequently want to know if they may claim tax deductions on both their company's HRA and the tax benefit on their home loan interest and principal repayment. There can be a number of reasons why a person cannot live in a house they have. In this case, the landlord may take up rented accommodation near his place of employment. In such a case, the income tax laws allow a person to claim HRA deductions and tax benefits from the principal and interest repaid on the home loan.

HRA is a special allowance paid as a part of one’s salary by his employer to meet the rental expenses of accommodation in that city. A general confusion among the salaried class is whether they will have to forego the exemption benefit of House Rent Allowance received from their employer in order to claim a deduction of interest on the home loan serviced by them? You may claim both HRA exemption and interest deduction on a home loan provided certain requirements as per the Income Tax Act, 1961 (‘the Act’) are met. This article aims to offer a detailed explainer regarding all possible scenarios and the amount one can claim for both HRA exemption and interest deduction on a home loan. You can deduct up to Rs 2 lakh in interest payments on a home loan in a financial year under Section 24, and you can deduct up to Rs 1.50 lakh in principal repayments under Section 80C.

Claiming tax benefits on house rent allowance

However, even under such circumstances, the Income Tax Act allows the claiming of HRA deduction along with home loan tax benefits. However, there is a condition – the distance between the home for which you’ve applied for a housing loan, andworkplace should be more than 35 km. If an under-construction home loan applicant files for an HRA deduction, they are eligible to claim it along with housing loan tax benefits. And once the construction of the property is over, they can claim for reduction of the total home loan interest paid till the date of property completion.

Hence some companies are extra cautious and ask for additional documents. Actually pay the rent through Cheque/ECS etc. and receiver should give rent receipt for the same. Rs 9,000 being the least of the three amounts will be the exemption from HRA. The tenure period of a Personal Loan starts from 3 months and goes all the way up to 6 years. Depending on his need short-term or long-term - borrower can ask for a tenure that suits his needs.

As both home loan interest tax exemption and HRA fall under different sections, you are allowed to claim both HRA and home loan benefits. The income tax department has made provisions to ensure citizens owning a house but if you are staying in a rented flat then do not miss out on tax benefits. Income Tax Act allows a deduction for interest on home loans paid by an individual taxpayer.

You may consult your local advisors for information regarding the products, programs and services that may be available to you. You may receive e-mails /communications/notifications from the Third Party Services Providers regarding facilities updates, information/promotional e-mails/SMS and/or update on new product announcements/services in such mode as permitted under law. You are advised to consult an investment advisor in case you would like to undertake financial planning and / or investment advice for meeting your investment requirements.

Online HRA calculators will ask you for your salary breakdown and compute your HRA. I am taking a home loan and will be paying the EMI, but my mother is only owner of that home. They are easy to get, require little to no documentation, don’t ask you to put up any collateral, and unlike other loans, Personal Loans can be used for anything you want. A health insurance policy provides financial protection to the policyholder against planned or unplanned medical expenditures.

Any reference to past performance in the information should not be taken as an indication of future performance. The information is dependent on various assumptions, individual preferences and other factors and thus, results or analyses cannot be construed to be entirely accurate and may not be suitable for all categories of users. Hence, they should not be solely relied on when making investment decisions.

IndiaLends’ algorithms try to get the lowest possible interest rate product for the customer. Therefore, you can claim a deduction for HRA as well as interest since your workplace is in a different city, or that your office is too far from your house. But it should be noted that sufficient explanations need to be provided to the employer or the Income Tax authority in case there is a scrutiny of the details provided.

If PAN is not available, the landlord must provide you with a declaration to this effect along with his name and address, which the employee should file with his employer. The deadline for reopening income tax cases has been reduced from 6 years to 3 years. The National Court of Appeals for the Income Taxes will be appointed by individual taxpayers. You also need to submit a copy of the landlord’s PAN card if the rent paid is more than ₹1 lakh per annum.

No comments:

Post a Comment